Daily Archives: May 21, 2024

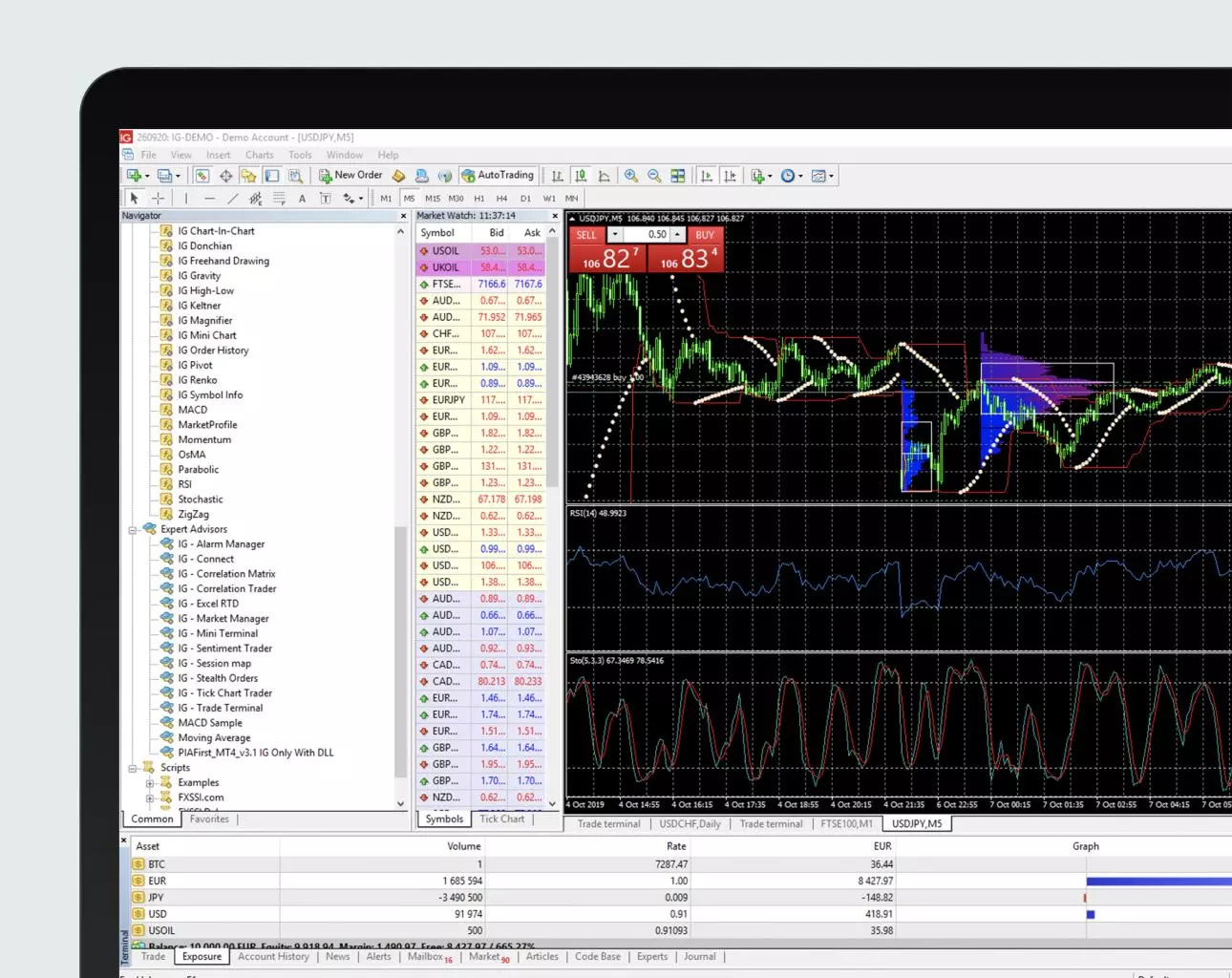

MetaTrader 4 (MT4) is a widely-used trading platform that offers powerful tools for forex and CFD trading. Among its many features, MT4 scripts stand out as a versatile tool that can help traders automate their strategies, improve efficiency, and reduce errors. If you’re a beginner looking to leverage metatrader 4 for windows scripts, this guide will walk you through the basics.

What are MT4 Scripts?

MT4 scripts are small programs written in MQL4 (MetaQuotes Language 4) that automate trading tasks on the MT4 platform. Unlike Expert Advisors (EAs), which run continuously and can manage trades automatically, scripts are designed to execute a single action or a series of actions when they are manually triggered. This makes them ideal for repetitive tasks or specific functions that traders need to execute quickly.

Benefits of Using MT4 Scripts

1. Time-Saving: Scripts can automate repetitive tasks, freeing up your time to focus on analysis and strategy.

2. Precision: Reduce the risk of human error by automating complex tasks.

3. Speed: Execute trades and other actions instantly, which can be crucial in fast-moving markets.

4. Customization: Tailor scripts to fit your specific trading needs and strategies.

Common Types of MT4 Scripts

1. Order Management: Scripts that help you place, modify, or close orders quickly. For instance, you can use a script to set stop-loss and take-profit levels for multiple orders at once.

2. Chart Analysis: Automate the drawing of trend lines, support, and resistance levels, or other technical indicators on your charts.

3. Alerts and Notifications: Set up scripts to notify you when certain market conditions are met, such as price reaching a specific level.

How to Install and Use MT4 Scripts

1. Download or Create a Script: You can find free scripts online or write your own using the MQL4 programming language.

2. Install the Script: Save the script file (.mq4 or .ex4) in the ‘Scripts’ folder located in your MT4 installation directory (usually under `MQL4/Scripts`).

3. Refresh the Navigator: Open MT4 and refresh the Navigator window to see the newly added script.

4. Execute the Script: Drag and drop the script onto the chart where you want to execute it. Configure any necessary parameters and click ‘OK’ to run the script.

Conclusion

MT4 scripts are a valuable tool for any trader looking to automate and streamline their trading activities. With a little bit of practice and experimentation, you can harness the power of scripts to enhance your trading efficiency and accuracy. Start by exploring some basic scripts and gradually move on to more complex ones as you become more comfortable with the platform. Happy trading!

Contracts for Difference (CFDs) have emerged as a popular financial instrument for traders seeking exposure to various markets without owning the underlying asset. In simple terms, a CFD is a contract between a buyer and a seller, where the buyer agrees to pay the seller the difference in the value of an asset between the time the contract is opened and when it is closed.

One of the key advantages of trading CFD how it works is the flexibility they offer in terms of leverage. Leverage allows traders to amplify their exposure to the market with a relatively small amount of capital. Unlike traditional trading methods, CFDs provide flexible leverage options, enabling traders to tailor their positions according to their risk appetite and market conditions.

CFDs cover a wide range of asset classes, including stocks, commodities, currencies, and indices. This diversity allows traders to access global markets and capitalize on opportunities across different sectors and regions. Moreover, CFD trading is typically commission-free, with costs primarily incurred through spreads, making it a cost-effective option for traders.

However, it’s essential to understand that CFD trading involves risks. Since traders speculate on price movements without owning the underlying asset, they are exposed to market volatility. Furthermore, leverage can magnify both profits and losses, making risk management crucial for CFD traders.

Despite the risks, CFDs offer several benefits, including the ability to profit from both rising and falling markets, access to a wide range of markets, and flexibility in leverage. By understanding how CFDs work and implementing sound risk management strategies, traders can potentially capitalize on market opportunities while managing their exposure effectively.